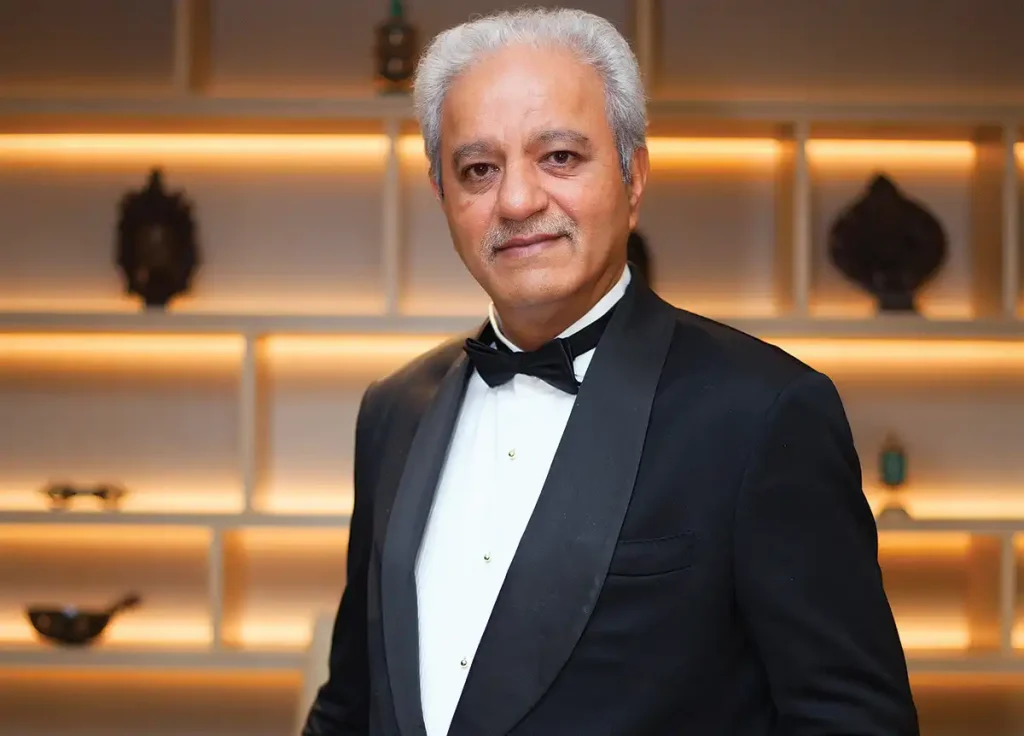

Delta Corp, India’s largest listed gaming and hospitality firm, has placed its ambitious integrated resort‑casino project in Dhargal, North Goa, on indefinite hold. Valued at approximately US $285 million (₹2,000–2,500 crore), the project was slated to open by 2027 and was poised to include hotels, a casino, convention center, multiplex cinema, retail spaces, water park, and other attractions. The halt comes amid mounting uncertainty over a proposed 40% Goods and Services Tax (GST) levy on bets, coupled with retrospective tax claims from government authorities. Delta Corp’s chairman, Jaydev Mody, warned that such taxation would render the sector unviable—jeopardizing thousands of jobs, tourism revenue, and prior investments—and stressed that the project will remain suspended until the GST framework is clarified.

The company is also grappling with staggering tax liabilities—estimated at US $2.8 billion—despite its market capitalization standing at just around US $420 million. The crux of the dispute lies in the tax authorities’ approach of imposing GST on the gross bet value (the total money wagered), rather than on gross gaming revenue (the actual amount retained after payouts), a move that Delta Corp contends is both arbitrary and unlawful. The firm has assured that it will exhaust all legal avenues to challenge these demands.

Beyond the financial strain, the decision to suspend the project signals broader caution for the gaming and tourism industries in India. Even though Delta Corp remains operational—including its onshore, offshore, and floating casinos across Goa and Sikkim—the uncertainty surrounding regulatory policy has dampened its expansion outlook. Until there is clear and stable tax direction, Delta Corp’s much‑anticipated Goa integrated resort stands in limbo, reflecting how sensitive large-scale tourism investments have become to shifting fiscal frameworks.

Content Writer: Janice Chew • Thursday, 25/09/2025 - 23:17:00 - PM

Content Writer: Janice Chew • Thursday, 25/09/2025 - 23:17:00 - PM