Macau’s gaming sector is poised for a powerful surge during the eight-day October Golden Week holiday, with Citigroup analysts estimating gross gaming revenue (GGR) could average around MOP 1.05 billion (approximately US $131 million) per day—paralleling the strong performance seen during May’s Labour Day break. This robust outlook stems from not only high visitor inflows but also the city’s strategic deployment of high-profile events aimed at extending the momentum well beyond the holiday period.

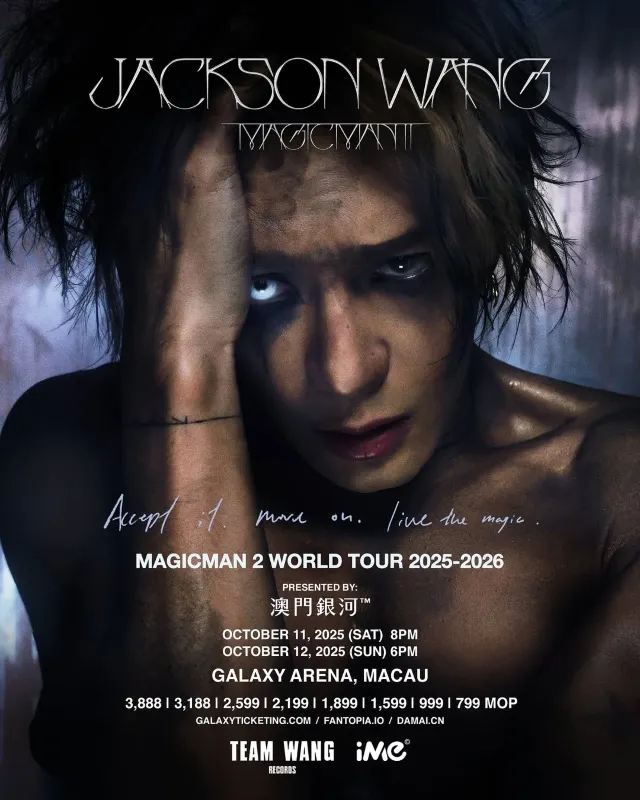

A key element of this extended boost lies in the heavy events calendar planned post-Golden Week, including the NBA China Games between the Phoenix Suns and Brooklyn Nets at Venetian Arena, as well as a major Jackson Wang concert at Galaxy Arena. These large-scale attractions are intended to sustain elevated gaming volumes and potentially propel October’s total GGR beyond Citi’s current projection of MOP 23 billion (US $2.86 billion), suggesting the firm’s forecast may prove conservative.

Beyond event-driven demand, Citi’s renewed confidence underscores longer-term tailwinds within Macau’s gaming narrative. The investment bank has raised its forecast for full-year 2025 GGR to growth of 10% year-on-year (up from 7%), implying a run-rate increase of 14% from now through year-end and a projected total of MOP 248.6 billion (US $31.1 billion). Prospects for 2026 are also optimistic, with a revised forecast of 7% growth. Citi attributes this enhanced outlook not only to concert/event-based demand but also to improvements in hold rates, particularly through new baccarat side bets available via smart tables, which bolster casino margins.

Content Writer: Janice Chew • Wednesday, 25/09/2025 - 22:24:31 - PM

Content Writer: Janice Chew • Wednesday, 25/09/2025 - 22:24:31 - PM