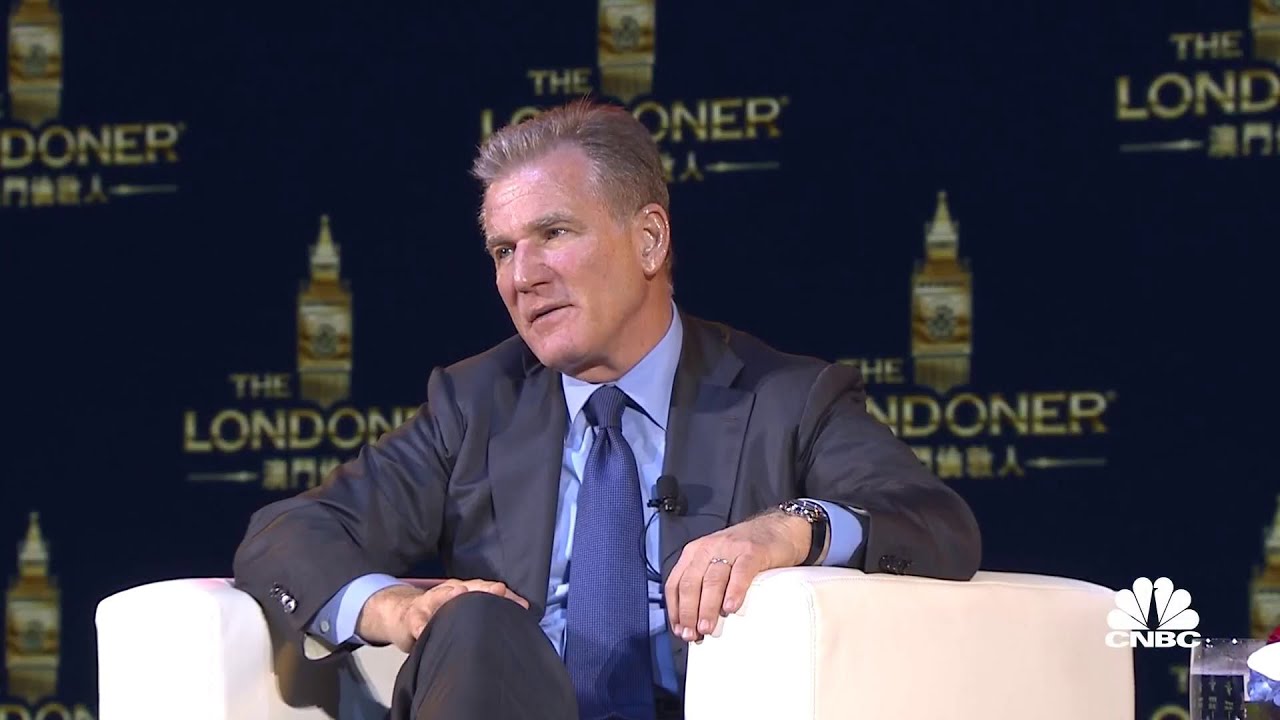

Robert G. Goldstein, Chairman and CEO of Las Vegas Sands Corp. (LVS), has announced plans to divest “some or all” of his company shares before stepping into the role of Senior Advisor starting March 1 2026. Reported filings show that on October 27 2025 he sold roughly 300,000 common shares — valued at ~$17.8 million at the market close — and that further sales may follow.

The company’s disclosure clarifies the motivation behind the sales: Goldstein aims to pursue financial diversification and the sales are not indicative of a lack of confidence in the company’s future. “Goldstein’s belief in the company’s prospects remains strong, and the stock sales are intended solely for financial diversification purposes.” the filing states. This timing aligns with the previously announced transition: in March 2025 LVS revealed that Goldstein will move to Senior Advisor and that current President & COO Patrick Dumont is expected to take over as Chairman & CEO as of March 1 2026.

Analysts may view the sale of such a large holding by the CEO as a signal to watch, yet LVS’s commentary emphasises this isn’t about a lack of future opportunity but personal portfolio strategy. For investors, the dual news of share sales plus an impending leadership hand-off may invite closer scrutiny of corporate governance, executive incentives, and succession stability. The planned move by Dumont underscores continuity: he joined LVS in 2010, became CFO in 2016 and has held his current role since 2021.

From a corporate perspective, the announcement underscores a broader strategic moment for Las Vegas Sands: moving from its long-standing leadership era into a new chapter under Dumont’s leadership, while retaining Goldstein’s counsel in an advisory capacity through March 2028. The advisor role will focus on government relations, development opportunities and gaming strategy—areas in which Goldstein has long been active.

In sum, the decision by Goldstein to sell a substantial portion (or all) of his shares ahead of his transition is a multifaceted signal: one of personal financial planning, but also of a crystallising succession phase at LVS. For shareholders and the market, the key items to monitor include how LVS navigates this leadership hand-off, what the timing and magnitude of further share sales may be, and whether this move has any implications for company strategy or investor perception.

Content Writer: Janice Chew • Tuesday, 25/10/2025 - 15:46:58 - PM

Content Writer: Janice Chew • Tuesday, 25/10/2025 - 15:46:58 - PM