Genting Singapore is entering a pivotal capital management phase, with around US$3.4 billion in debt maturities looming over the next few years. According to multiple industry reports, the group is weighing a mix of refinancing tools – including potential retail bond issuance and a recalibration of dividend payouts – to optimise its balance sheet while funding expansion.

Dividend Strategy Under Review

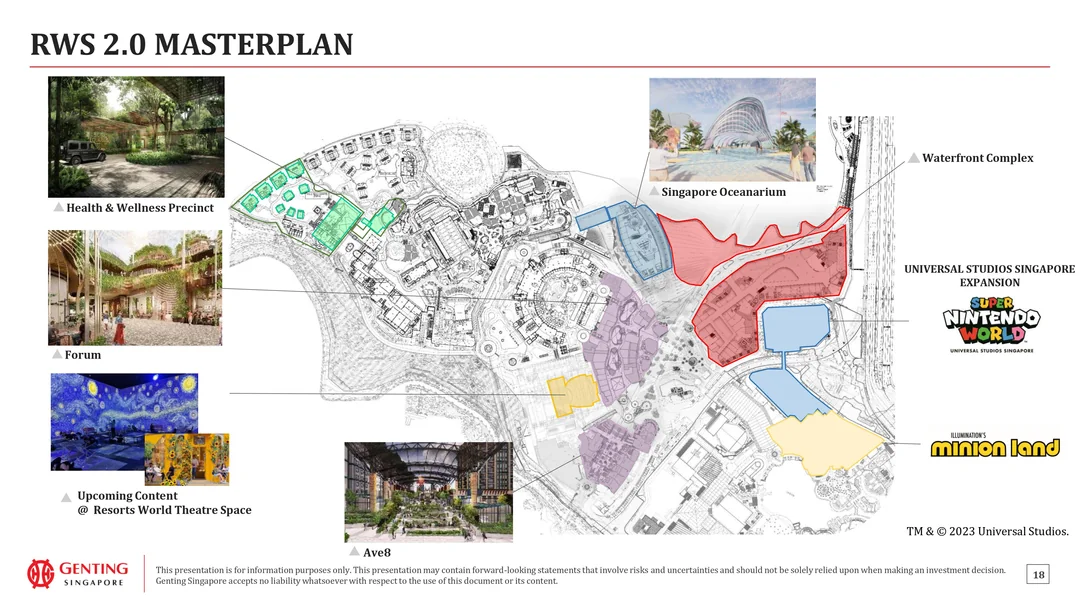

Recent commentary suggests Genting Singapore’s historically generous dividends could be adjusted as management prioritises liquidity and funding flexibility. This comes as the company continues to invest heavily in the RWS 2.0 transformation at Resorts World Sentosa, which includes new attractions, hotel upgrades and non-gaming amenities aimed at boosting premium mass and MICE segments.

For investors, this signals a shift from yield-led attraction to growth and balance sheet resilience. In a higher-rate environment, preserving cash may be more strategically valuable than maintaining oversized payouts.

Retail Bonds Back on the Table?

Reports indicate the Genting Group could revisit Singapore’s retail bond market as part of its refinancing toolkit. Retail bonds would broaden funding sources beyond traditional bank loans and institutional debt markets, while tapping domestic liquidity from Singapore’s strong retail investor base.

The move would align with past capital market strategies across the wider Genting ecosystem and could help stagger maturities to avoid concentration risk.

Integrated Resort Momentum Remains Intact

Operationally, Genting Singapore continues to benefit from resilient visitor flows and tourism recovery in Singapore. Sector data from the Singapore Tourism Board shows sustained inbound travel, particularly from China and Southeast Asia, supporting integrated resort visitation.

This places Genting Singapore in a relatively strong operating position compared to regional peers, even as it navigates refinancing pressures.

Strategic Takeaway for IR Investors

For Asia gaming and IR policy watchers, this development underscores three themes:

-

Capital discipline over dividend optics

-

Diversified funding channels (including retail markets)

-

Long-term asset enhancement at Resorts World Sentosa

Rather than signaling distress, the refinancing discussion reflects proactive treasury management ahead of maturities. The key variables to watch will be:

-

Final dividend policy decisions

-

Timing and structure of any retail bond issuance

-

Debt maturity extension profile

-

Continued performance of RWS’ premium mass segment

In short, Genting Singapore is shifting from a pure yield story to a capital-optimisation narrative – a transition that could strengthen its financial flexibility as regional IR competition intensifies.

Content Writer: Janice Chew • Wednesday, 26/02/2026 - 11:38:33 - AM

Content Writer: Janice Chew • Wednesday, 26/02/2026 - 11:38:33 - AM