Macau Legend has publicly pushed back against claims surrounding the recent takeover of its Cape Verde development, stating it never agreed to release the project to the local government and is now formally challenging what it describes as an unlawful seizure of assets.

The dispute adds a new layer of complexity to the company’s long-running overseas investment and underscores the growing political and legal risks faced by Asian gaming operators expanding beyond their home markets.

Company Denies Any Voluntary Handover

In a clarification issued following recent reports, Macau Legend stressed that it did not consent to any transfer of ownership or control of its integrated resort project in Cape Verde. The company said it remains the rightful holder of the project rights and is seeking professional legal advice to determine its next steps.

This directly contradicts earlier government statements suggesting the project had reverted to state control due to prolonged inactivity and unmet development milestones.

Background: A Project Mired in Delays

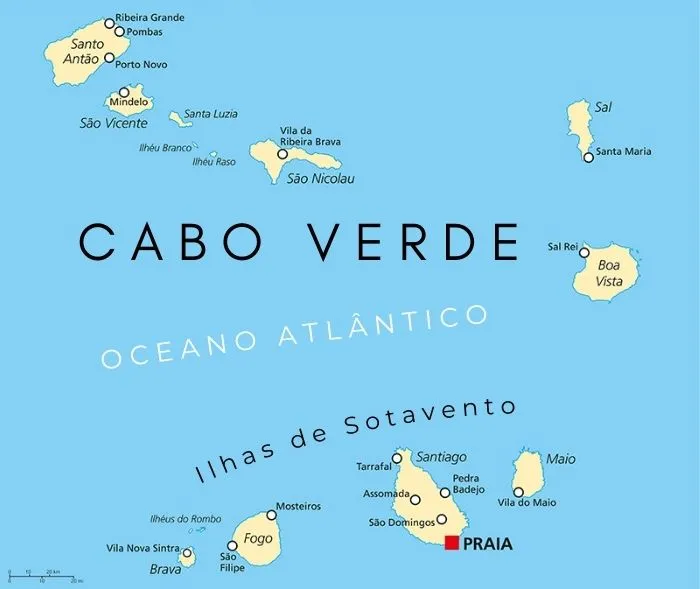

The Cape Verde project, located near the capital Praia, was originally positioned as a catalyst for tourism and cruise-related development. However, construction delays, financing challenges, and the global pandemic significantly slowed progress, leaving the site incomplete for several years.

Government authorities argue that the seizure is intended to safeguard national interests and restart stalled infrastructure. Macau Legend, however, maintains that external factors and regulatory hurdles contributed to delays—and that these do not justify unilateral state action.

Legal and Investment Implications

Legal experts note that disputes of this nature often hinge on the fine print of development agreements and concession terms. Macau Legend is understood to be reviewing:

-

Whether the seizure breaches contractual obligations

-

Potential protections under international investment frameworks

-

Options for compensation or asset restitution

If escalated, the matter could evolve into a prolonged legal battle, potentially involving arbitration outside Cape Verde.

A Broader Warning for the Gaming Industry

From an industry perspective, the episode highlights the elevated sovereign and execution risks associated with large-scale, capital-intensive projects in emerging markets. While overseas diversification offers growth beyond Macau, it also exposes operators to abrupt policy shifts and enforcement actions that may not align with commercial expectations.

Analysts suggest that such developments may push gaming groups toward:

-

Asset-light partnerships

-

Phased investment structures

-

Greater reliance on political-risk insurance

What Comes Next

For Macau Legend, the immediate focus is on legal clarity and reputational management. For investors and peers, the situation serves as a reminder that international expansion—particularly into developing jurisdictions—requires not just capital, but deep legal foresight and contingency planning.

As the dispute unfolds, it will be closely watched across the gaming sector, both for its financial consequences and for the precedent it may set on how overseas casino investments are treated when projects stall.

Content Writer: Janice Chew • Wednesday, 26/01/2026 - 14:26:57 - PM

Content Writer: Janice Chew • Wednesday, 26/01/2026 - 14:26:57 - PM