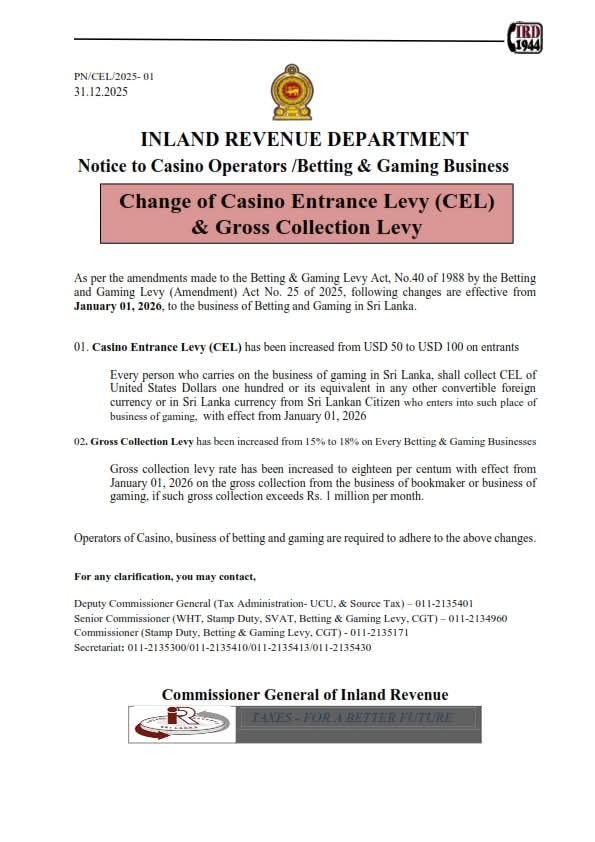

Sri Lanka’s government has enacted significant changes to its casino and gaming tax regime effective January 1, 2026, doubling the casino entrance levy for local citizens and increasing the gross collection levy on gambling businesses. According to an official Inland Revenue Department notice, the **Casino Entrance Levy (CEL) now stands at USD 100 per local entrant, up from USD 50 previously — a direct effort to generate higher government revenue and moderate domestic gambling participation.

In addition to the entrance levy, the Gross Collection Levy — a key tax on betting and gaming operators — has been raised from 15 % to 18 % on monthly gross collections exceeding LKR 1 million (about USD 3,200). This adjustment means operators now owe a larger portion of earnings to the state, reflecting Colombo’s broader fiscal strategy to strengthen public finances following years of economic strain.

These tax measures are embedded in the Betting and Gaming Levy (Amendment) Act No. 25 of 2025, which amended Sri Lanka’s foundational gambling tax framework. The changes had been widely anticipated after Sri Lanka’s cabinet approved higher levies and fee increases in 2025, and the statutory update was formalised in government gazette notices ahead of the start of 2026.

The timing coincides with the rising profile of Sri Lanka’s gaming sector, notably following the opening of the City of Dreams Sri Lanka integrated resort casino in Colombo, a major investment by John Keells Holdings and Melco Resorts & Entertainment. Policymakers have indicated that these fiscal adjustments will help capture greater economic value from a sector expected to attract tourists and high-spending visitors.

While higher levies are generally aimed at boosting revenue, they also intersect with social objectives: the elevated entry fee for locals is seen as a tool to discourage excessive domestic gambling, even as the country seeks to balance tourism growth and regulatory oversight in a rapidly developing gaming landscape.

Content Writer: Janice Chew • Saturday, 26/01/2026 - 15:21:00 - PM

Content Writer: Janice Chew • Saturday, 26/01/2026 - 15:21:00 - PM