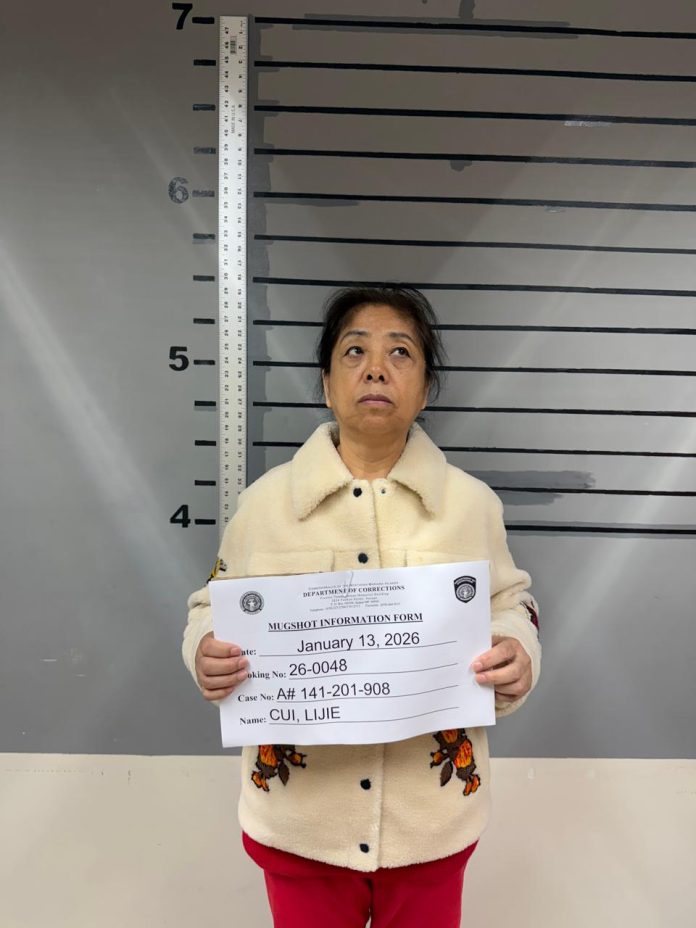

United States Immigration and Customs Enforcement (ICE) has arrested Cui Lijie, the 68-year-old Chinese billionaire and majority shareholder of Imperial Pacific International (IPI), on alleged immigration violations in the United States, according to multiple recent reports. Cui was booked and is being held at the Commonwealth of the Northern Mariana Islands (CNMI) Department of Corrections while details of the alleged violations and the timeline of the investigation remain sparse. Authorities have not yet released specific charges or indicated how long the probe has been underway, though local court records confirm her detention pending an upcoming immigration hearing.

Cui’s arrest occurs amid ongoing fallout from IPI’s troubled operations and bankruptcy proceedings. Imperial Pacific’s Saipan casino project, once poised to be a major integrated resort in the Northern Mariana Islands, filed for Chapter 11 bankruptcy in April 2024, citing liabilities exceeding $165.8 million. In early 2025, IPI’s assets, including the casino license and property, were acquired by Team King Investment (CNMI) LLC through a court-approved auction after creditor objections were resolved, effectively transferring control away from the legacy ownership.

The Saipan casino saga has been marked by long-running legal and financial challenges, including operational shutdowns since the pandemic, unpaid liabilities, and regulatory scrutiny both in the U.S. and abroad. IPI’s collapse also follows years of controversy surrounding the company and its leadership — with past investigations by U.S. and Chinese authorities into various alleged offences linked to casino operations and related business practices.

Cui Lijie’s detention highlights broader issues facing foreign casino operators in U.S. territories, particularly regarding compliance with immigration and labor laws. As she awaits further legal proceedings, the future of remaining legal matters related to Imperial Pacific’s former operations continues to unfold, with local courts moving toward asset liquidation and distribution under bankruptcy supervision.

Content Writer: Janice Chew • Wednesday, 26/01/2026 - 23:34:40 - PM

Content Writer: Janice Chew • Wednesday, 26/01/2026 - 23:34:40 - PM